DeSantis Signs Tax Package With Sales Tax Holidays, Insurance Cuts

May 8, 2024

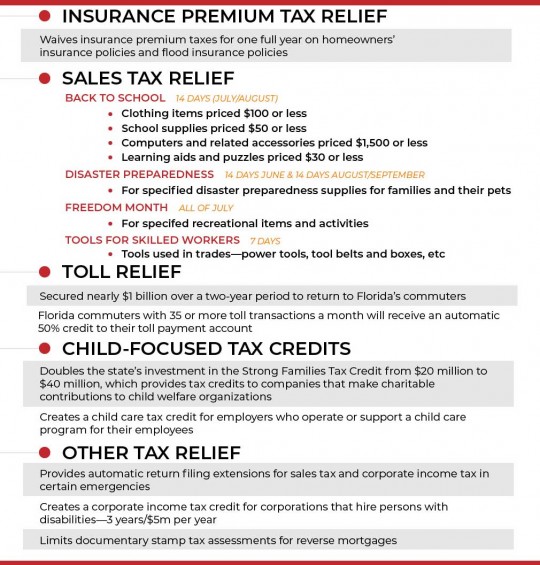

Florida Gov. Ron DeSantis on Tuesday signed multiple tax holidays into law, which he says will provide $1.07 billion in tax relief for Floridians this year.

The tax package will help homeowners by providing a one-year exemption on taxes on residential property and flood insurance premiums. This is in addition to the $200 million that was signed last month for the My Safe Florida Home Program, bringing the total investment to the program to over $600 million since 2022. Since the governor signed reforms in 2022 and 2023, eight new companies have joined the homeowners insurance market in Florida. The success of these reforms is becoming increasingly clear in rate filings for insurers. In fact, 10 companies have filed a zero percent increase and 10 more have filed a rate decrease to take effect in 2024.

Additionally, this year’s tax cut package is a continuation of our annual tax holidays. These tax holidays include:

- Two Disaster Preparedness Holidays; June 1—14 and August 24—September 6, families can prepare for hurricane season with items like tarps, batteries, and flashlights, sales tax free.

- The Back-to-School Sales Tax Holiday: July 29—August 11, families can save on pens, pencils, computers, clothing, and other school supplies.

- The Tool Time Sales Tax Holiday: September 1—7, Floridians can save on power tools, hand tools, toolboxes, and other items.

- The Freedom Month Sales Tax Holiday: July 1—31, Florida families can purchase summer items like pool floats, fishing supplies, and outdoor equipment, in addition to admissions to museums and state parks, sales tax free.

More information is in the graphic below.

Among other savings, the tax relief package also includes a sales tax credit for businesses that employ persons with disabilities. Additionally, the bill increases the cap for the Strong Families Tax Credit Program from $20 million to $40 million, which supports organizations focused on child welfare.

Photo for NorthEscambia.com, click to enlarge.

Comments

One Response to “DeSantis Signs Tax Package With Sales Tax Holidays, Insurance Cuts”

“provides tax credits to companies that make charitable contributions to child welfare organizations”

This will be easy for companies to take advantage of because I have been asked numerous times by various businesses at point of checkout if I’d like to donate to this or that…and most times I do. But, the companies use our solicited contributions to earn this tax credit! The companies themselves put up a fraction and then earn all this money from the tax credit. Kind of a double edged sword I guess.

Contributions directly to the organization is ideal, but not many take the time to do so (not convenient) and feel they are doing good by donating at a register. (they are in some respects)