County Receives Increased BTC Offer Of $25 Million For OLF-8, But There Are Several Potential Sticking Points

May 17, 2024

Beulah TownCenter, LLC (BTC) has increased their purchase offer to $25 million for 290 acres of the county-owned OLF-8 property on Nine Mile Road.

After negotiations on the original BTC and partner Fred Hemmer offer of $22 million, they returned with the higher offer and revised contract language.

The county still has an offer on the table for local potential buyers Cliff Mowe, land developer, and Ryan Chavers, owner of a construction company.

“Additionally–I was contacted by representatives of a new interested party. This large development firm based in Alabama will be visiting the Pensacola area next week and I am told they are very interested in the OLF 8 property,” Commissioner Jeff Bergosh wrote on his blog.

“The OLF 8 sale/development issue is once again heating up,” Begosh wrote. “My hope is that we will soon be able to settle in on one of these offers and move this initiative forward. If we are able to sell the 290 acres at $25 Million–this will be an immediate $10 Million Dollar windfall for our LOST fund that will provide monies for badly-needed infrastructure projects district wide.”

Escambia County staff has provided commissioners with a summary of the increased BTC offer, including several possible sticking points.

“Bergosh said the commission will discuss OLF-8, including the latest offer, at their next meeting on Monday.

He wrote, “Folks on BOTH sides of this proposed transaction need to iron every one of these bullet points out prior to Monday so we are not, once again, trying to push a wet noodle up a hill on this. It is time to fish or cut bait–no more Kabuki Theater…..Produce a contract we (the BCC) can make an up or down vote on!”

The county staff provided commissioners with the following bullet points:

- BTC adds back/deletes much of what was deleted/added in the County’s previous draft.

- BTC increases the purchase price from $20,000,000 to $25,000,000.

- BTC increases the deposit from $20,000 to $25,000, with an additional $250,000 deposit upon approval of BTC’s preliminary site plan.

- There is really no situation where BTC will be unable to recover the deposit if the transaction does not close.

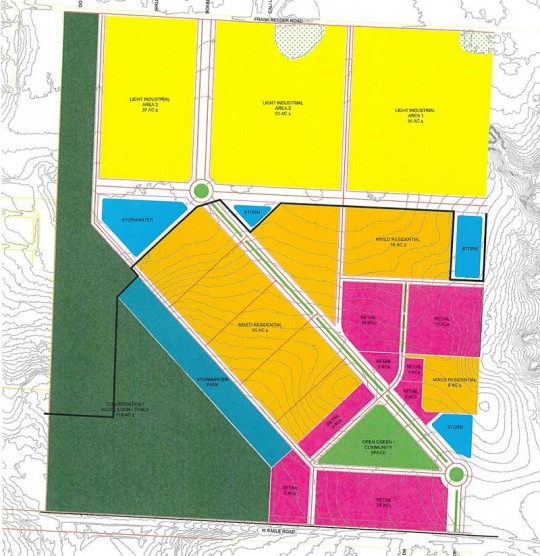

- BTC does not commit to build anything or adhere to the master plan prepared by DPZ CoDesign. Instead, it defers that issue to be resolved by a Master Development Agreement and Declaration of Covenants, Conditions, and Restrictions that will be negotiated after the Purchase and Sale agreement.

- BTC requires all development approvals ahead of closing and incorporated in the Master Development Agreement.

- BTC deletes references to the provisions, covenants, and other duties and obligations in the quit claim deed from the USA to the County; the quit claim deed from the USA requires the County to incorporate those references in subsequent transactions.

- The Agreement makes several references to warranties of title; the County cannot provide warranties of title by statute.

- The Agreement requires the County to pay the documentary stamp tax; the County is precluded from paying these by statute.

- The Agreement contains several provisions that require the County to indemnify and hold BTC harmless and pay its attorney’s fees in the event of default, breach, or other dispute.

- BTC requires the remedy of specific performance for breach, default, or otherwise refusing to pursue its obligations in the Agreement.

- The County would be required to pay all BTC’s actual damages (i.e., all out-of- pocket costs) if the County does not close.

- BTC requires the County to record a restriction on the County’s northern remainder of the property to light-industrial uses; the County would not be able to allow the use of the remainder for residential or retail purposes without the written consent of BTC.

- BTC requires a right-of-first refusal for the County’s northern remainder of the property.

- BTC adds back/deletes much of what was deleted/added in the County’s previous draft. BTC increases the purchase price from $20,000,000 to $25,000,000. BTC increases the deposit from $20,000 to $25,000, with an additional $250,000deposit upon approval of BTC’s preliminary site plan. There is really no situation where BTC will be unable to recover the deposit if thetransaction does not close. BTC does not commit to build anything or adhere to the master plan prepared byDPZ CoDesign. Instead, it defers that issue to be resolved by a MasterDevelopment Agreement and Declaration of Covenants, Conditions, andRestrictions that will be negotiated after the Purchase and Sale agreement.

- BTC requires all development approvals ahead of closing and incorporated in theMaster Development Agreement. BTC deletes references to the provisions, covenants, and other duties andobligations in the quit claim deed from the USA to the County; the quit claim deedfrom the USA requires the County to incorporate those references in subsequenttransactions. The Agreement makes several references to warranties of title; the County cannotprovide warranties of title by statute. The Agreement requires the County to pay the documentary stamp tax; the County is precluded from paying these by statute. (Section 10.2) The Agreement contains several provisions that require the County to indemnify andhold BTC harmless and pay its attorney’s fees in the event of default, breach, orother dispute. BTC requires the remedy of specific performance for breach, default, or otherwiserefusing to pursue its obligations in the Agreement. (Section 14) The County would be required to pay all BTC’s actual damages (i.e., all out-of-pocket costs) if the County does not close. BTC requires the County to record a restriction on the County’s northern remainderof the property to light-industrial uses; the County would not be able to allow the useof the remainder for residential or retail purposes without the written consent of BTC.

- BTC requires a right-of-first refusal for the County’s northern remainder of the property.

Bergoh said the commission will discuss OLF-8, including the latest offer, at their next meeting on Monday.

Comments

13 Responses to “County Receives Increased BTC Offer Of $25 Million For OLF-8, But There Are Several Potential Sticking Points”

Why not build a 4-H camp there with all the amenities that the LBC camp once had, including a lake, cattle, timber cabins and etc…

Yep, would love to see a Costco here, but I’m sure the commissioners would block that or make it so hard for them to build one they walk away. Yea, just what we need more apartments. Also how much money has the county spent on all of this so far? Of course we’re going to pay for it. Developers in the pockets of the commissioners??

Randy,

It was a “collard green pot” if I remember correctly.

Not many will get it these days.

It was a similar deal that they got caught in.

A Costco and a nice park is the best idea yet…no more single family homes, and certainly NO MORE APARTMENTS!!

Yep Frank, in fact they even require that the county approve everything before it is even purchased! In addition they openly state they aren’t going to follow any plans that are already in place and approved, and they want to tie up all the potential property around it as well on the later chance they can con another commission into giving them more.

Why are we expecting this sale to “shore up” LOST funds. LOST stands for Local option sales tax and those project are dependent on said tax revenue- not sale of county property. What are we going to do when you run out of things to sell?

Thanks but no thanks.

The plan looks nice to me. They need to keep as much reservation/trails/water as possible. Also, please no more strip malls, aluminum buildings, self-storage spaces. We have enough of those on 9 mile and in the immediate vicinity anyways. At least make it worth the investment, strip malls do nothing for the future, only short term gains.

Short arms and deep pockets. It’s all for sale to the highest bidder and that’s all that is of the utmost importance. Quality of life has no place anymore in local government oversight due to those that have been given free reign to do as they please. So sad to see this area just sold away chunk by chunk to those with the only interest is how much their going to profit from it either politically or financially.

Fit as many single family homes as possible and ban investors from renting/leasing them out for 10 years. This may help the unaffordable housing crisis. Make it walkable to help with traffic. Screw the nimby’s.

Tell them to walk Jeff. The county is sitting on a gold mine. I’m scared this commission is going to make another rash land sale just for a photo open or a crock pot.

Take the money and run to Pine Forest north of I-10.

LMAO

Question… BTC does not commit to build anything or adhere to the master plan prepared by DPZ CoDesign. Instead, it defers that issue to be resolved by a Master Development Agreement and Declaration of Covenants, Conditions, and Restrictions that will be negotiated after the Purchase and Sale agreement.

Is that a Democrat clause… “Let’s pass it then read it” ???

..Great I idea John…the county polititions

are beating this thing to death…and have plenty of money already..

Putting a Town Center there is a horrible idea. You are never going to compete with Cordova Mall or Downtown Pensacola. Just sell 50 acres to Costco and turn the rest into a park.