Grocery Tax In Alabama Lowered By 1%; Walmart Error Double Taxes Customers Friday

September 1, 2023

The tax on food in Alabama was lowered by 1% on Friday under a bill passed by the Alabama legislature.

The state’s sales tax was lowered from 4% to 3% on food items. Most counties and municipalities add additional sales tax, making the full tax over twice as much. On September 1 of next year, the tax on food items will be lowered another 1% if conditions are met — if the growth from other tax sources is up by at least 3.5% for the Education Trust Fund.

On Friday, Walmart and Sam’s Clubs across the state were mistakenly double taxing items.

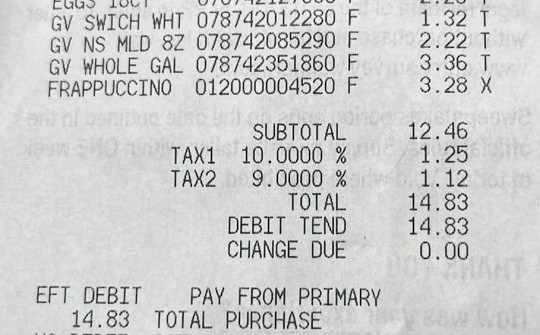

“Earlier today, some Walmart customers and Sam’s Club members across Alabama were incorrectly overcharged sales tax while shopping with us. Effective Sept. 1, the sales tax rate on food decreased by one percentage point statewide. Our systems mistakenly charged both the old rate and the new rate at the time of sale,” according to Walmart. “The situation is being corrected, and we’re asking potentially impacted customers to take their receipts to their nearby stores or clubs for a refund of the higher sales tax.”

Before Friday, Alabama was one of three states that charged full tax on groceries. There is no tax on groceries in Florida.

Pictured: A Walmart receipt from Friday, September 1 showing a customer in Alabama double taxed on a food purchase. Photo for NorthEscambia.com, click to enlarge.

Comments

10 Responses to “Grocery Tax In Alabama Lowered By 1%; Walmart Error Double Taxes Customers Friday”

Has happened to me multiple times. I ash an Walmart employee about it and she said, “oh, one tax is for groceries and the other tax is for miscellaneous items. So in reality, I paid more tax than had they not lowered the grocery tax. Ugh

Happened to me yesterday Sept. 7th, I was taxed twice at a Mobile Wal-Mart. When I checked on it today at the customer service counter, I was told by a very rude employee, that it was a new store tax Gov. Ivey requires all Alabama residents to pay.

just happen to me at dollar store in flomaton Tax 1 and Tax 2; tried to talk to manager but they act like they don’t know sh_t…never again…..o’biden_economics at work

I never purchased my groceries in the state of Alabama, which I live in when I can go less than a mile across state line to buy my groceries and not have to pay taxes. It’s ridiculous. We live in a state that taxes us to death. It’s time to move on Alabama. It’s up to you, keep losing money or get with the program..

Alabama wants to tax people to death! I would NEVER want to live in that state just for that reason!! Really surprised they don`t tax you on your taxes

Lucky 2 live near Pensacola. Before going home I always pick up groceries to save on that tax. When U purchase over $400 worth that saves me roughly $40.00 which can go to other things

Alabama has the ninth (9th) lowest taxes on cigarettes of the fifty states. Raising taxes there might be a good idea for replacing lost grocery revenues.

I live in Alabama, but I buy my groceries in Florida whenever I get the chance. The 10% tax on groceries and medicine is ridiculous, especially with todays inflation.

Realest, we pay astronomical high prices for groceries now. . Even with the 1 percent tax cut the State is collecting way more $$$ in sales tax than before the huge price increases went into effect. They hoped and succeeded in fooling simple minded folks

Fantastic! Now that means they are going to raise your state income tax 1%. They’ll get that money from somewhere.