Three Years After Tornado, Damaged Sawmill Still Looms Over Century Neighborhood

March 18, 2019

Century has mostly recovered from the EF-3 tornado that ripped through the town just over three years ago. But there’s still on giant problem looming over the town.

The destruction of the Alger Sullivan Lumber Mill is easy to spot behind the neat row of houses that have been repaired on the historic Front Street.

It appears the property is owned by a company that ceased to exist a decade ago. Escambia County has piled fines and fees onto the company, with new fines added with each passing day.

The 38-acre abandoned industrial property was heavily damaged and has sat mostly untouched since 150 mph tornado winds the afternoon of February 15, 2016.

The 38-acre abandoned industrial property was heavily damaged and has sat mostly untouched since 150 mph tornado winds the afternoon of February 15, 2016.

The property owner — listed in county records as DMT Holdings LLC in Navarre –was cited years ago by Escambia County Code Enforcement. The limited liability company was dissolved in 2008.

With no response from the owners. a special magistrate for Escambia County issued an order against the property at One Lumber Road on October 4, 2016, giving the owners until November 1, 2016, to clean up the property. The county provides code enforcement services under an interlocal agreement within the town limits of Century.

Failing to comply, the property owners were assessed costs of $1,100, and fines of $50 per day have been accruing ever since. To date, the property owners, if they exist, owe fines of about $45,000.

Escambia County crews entered the property in 2018 and performed some cutting and trimming, cleaned around a concrete ditch, removed four 30-yard dumpsters of debris and replaced 80-feet of chain link fence that was down. The Mosquito Control Division was also on site to inspect and treat any areas that were favorable for mosquito breeding. The cleanup area was concentrated on the portion of the property behind residences on Front Street.

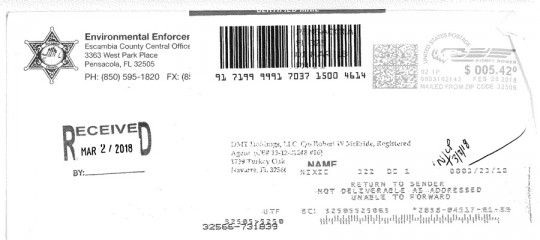

The cleanup cost assessed by the county was $5,450 — $2,589.29 for 150 hours of labor, $2,613.75 in equipment costs and $246.96 in material costs. Certified mail from the county to the listed owners was returned by the post office as invalid with no forwarding address.

The cleanup cost assessed by the county was $5,450 — $2,589.29 for 150 hours of labor, $2,613.75 in equipment costs and $246.96 in material costs. Certified mail from the county to the listed owners was returned by the post office as invalid with no forwarding address.

Escambia County received three bids for the demolition and cleanup of the mill last year, but the low bid was $800,000 — far in excess of the county’s entire cleanup budget of about $463,425. Property records show entire value of the property was $802,189 before the tornado, but the most recent assessment show what remains is worth $226,535.

Seizing the property under legal channels has also been problematic due to an outstanding mortgage and back taxes. A current tax bill of $19,520.84 is outstanding. Tax certificates have been sold on outstanding taxes for several other years.

The property is located within a Community Development Area established by the Town of Century. Discussions have been held around the Century council table about the sawmill, but no actions have been taken. The town has been powerless with no apparent legal standing to do cleanup or seize the property.

NorthEscambia.com and courtesy file photos, click to enlarge.

Comments

21 Responses to “Three Years After Tornado, Damaged Sawmill Still Looms Over Century Neighborhood”

Let us not forget that LLC means Limited Liability Corporation.

Its civil liability is limited to its assets. Don’t expect blood from the turnip.

Under Florida law, a party wishing to pierce the corporate veil must show that the corporation at issue is the mere instrumentality or alter ego of its shareholder(s) or its parent corporation, and that said shareholder or parent corporation engaged in improper conduct. Courts in Florida have enumerated a number of factors that may lead to piercing the corporate veil. While there is no set equation for the number of factors that must be present to pierce the veil (and in most cases there are three to five factors present), there are particular factors that raise red flags more so than others. A few worth noting are set forth as follows:

1. The existence of fraud, wrongdoing, or injustice to third parties.

https://www.lexology.com/library/detail.aspx?g=4ff8ebf0-4bca-426e-8273-758140f6d0eb

When they dissolved the LLC they should have disbursed the assets, one is holding a deed on the property and may have just not filed it, maybe.

https://www.legalzoom.com/articles/how-to-dissolve-an-llc

https://www.nolo.com/legal-encyclopedia/personal-liability-piercing-corporate-veil-33006.html

Pierce the Corporate Veil

The guys name is Robert McBride. He has a new company called Distinctive Entries.

This should not be tolerated

>>You can easily find the individuals. How incompetent is the government on this?

Sure, you can find them. But they don’t own it, the LLC does, and the LLC likely shields the individuals from any responsibility.

You can easily find the individuals. How incompetent is the government on this?

Look at the property appraiser site, go to the corporation go to Sun biz. Heck just google they guys name. He’s on another active company.

any body find him and his address. Can the States Attorney? Eyes are on you all.

From the bottom to the top. Don’t need to drag this out much longer.

Let’s do some simple math on this one;

The bank is not going to foreclose because then they will be stuck with all the costs associated with this property, including taxes, liens, clean up costs etc. which far surpass the value of the property. They have effectively washed their hands of it and probably written off their loss. The people that have bought tax certificates on this property are not going to push for title to the property for the same reasons, and they know that they will eventually get their money when it is settled because taxes trump all other liens. This leaves it up to the County Commission to do something. They will have to clear the property, and go through the Court System to get title to it. Like it or not, the County will have to act. So, if all the writers and readers here would raise a public outcry, Maybe Barry and gang will do something.

“The County should seize this.”: And do what with it? Commercial property in Century is not exactly burning up the market. In addition, there are probably the costs associated with cleanup and possible remediation of the property. Who really knows what’s in those building materials?

The taxes are paid by tax certificate. The County should seize this.

Isn’t the mortgage company a defunct LLC also? Isn’t anybody tracing this out?

Seems the bank that financed the deal is a correspondent “banker’s bank” called TIB Bank, whose former president, one Edward V. Lett, signed off on the note on 1/5/06 for one and a quarter million. All of that is public info courtesy of Escambia County Official Records. Mr. Lett retired in 2009 and was having cancer treatments at that time.

Perhaps someone could approach TIB Bank with a suggestion about what to do with this property since they’re the ones with the most to lose at this stage in the game.

@resident

Hence, why it’s called, a “write off”. You literally made my point in the first half of my paragraph, thank you for the specific numbers. And the sooner they take the loss on the higher value, the better, as once a market cooling occurs, the hemorrage will only be worse. Unless they are waiting decades to see what happens in the external market. It could be a family owned bank we’re talking about here, that’s ok with kicking the ball to the grandkids, but most boards/trustees (not to mention examiners) are okay with these types of loans staying on the books for years on end.

And just think of the higher risk of danger to the nearby residents if, God Forbid, another tornado strikes. So much debris sitting there unattached to anything – just waiting for a strong wind to pick it up and hurl it on some unfortunate….

” It would seem that they would want to seize the property and auction it off to the highest bidder”

Value of property $226,000 – 45,000 (code fines) – 100,000 (back taxes & certificates = $81,000 net value

$81,000 – $800,000 cleanup costs = $719,000 net LOSS.

-$719,000 – $25,000 attorney fees, title fees, closing costs – $100,000 environmental cleaning costs, zoning costs, marketing

NET LOSS of $800,000, sale price of $300,000 = HALF MILLION LOSS

Why would the mortgage company want to seize it? And who in their right mind would want it in the middle of Century?

Commercial liens and foreclosures are incredibly easy; the protections afforded to private citizens with home mortgages are non-existent in the commercial world. Why the bank that holds the mortgage to this property hasn’t seized it is a question for them; even with the low property value, it doesn’t make much sense. It would seem that they would want to seize the property and auction it off to the highest bidder, in it’s current condition, less the outstanding taxes and simply write off the rest. They may be holding off to see what happens with the greater economy and property values; but with a potential cooling of the market heading our way at some point in the future, now is probably the time to negotiate?

It’s a shame the county can’t get the mortgage company to write off the mortgage and then just give it to a company who is willing g to clean it up and develop it as they wish.

Perhaps the council members can receive a loan from Century and then spend it on clean up. Or King Hawkins can sell some of his airline tickets to help defray the cost.

who is paying the taxes? is no one the sell the tax deed.

CONSIDERING:

“If your house mortgage is not paid the mortgage company would now own your home and property deed.”

They would have to be foolish to close on the mortgage and take ownership just so they could be stuck with huge fines and bills. I don’t think anything forces them to seize it.

David for better business behavior

If your house mortgage is not paid the mortgage company would now own your home and property deed. They should be on the hook for this mess.

Just another eye sore in Century.