Low Tax Opportunity Zones Approved For Escambia County, Including Century

June 18, 2018

Great news – @USTreasury approved Florida’s Low Tax Opportunity Zones. These Zones will help foster continued success in our state by bringing new capital investment and more jobs to areas in every Florida county.

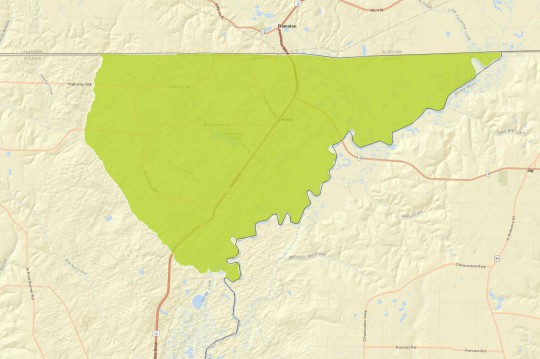

The U.S. Treasury has approved Gov. Rick Scott’s recommendation that seven census tracts in Escambia County be designated as “Opportunity Zones”, including Century and the immediately surrounding area.

“These Zones will help foster continued success in our state by bringing new capital investment and more jobs to areas in every Florida county,” according to the Governor’s Office.

Low Tax Opportunity Zones, as established in the federal Tax Cut and Jobs Act of 2017, encourage long-term investment and job creation in targeted communities by reducing taxes for many job creators. Low Tax Opportunity Zones enhance local communities’ ability to attract businesses, developers and financial institutions to invest in targeted areas by allowing investors to defer capital gains taxes through investments in federally established Opportunity Funds.

“The Pensacola area has created 19,400 jobs since December 2010 and these new Low Tax Opportunity Zones will spur even more private investment and job creation. I look forward to seeing the new businesses and jobs that are created in these target areas,” Scott said.

“These Zones will make a real and lasting difference in some of our highest-need areas by helping to bring new capital investment and more jobs to every county across the state. They will also bring additional investment to rural communities and urban areas, ensuring that every Floridian has the chance to live the American Dream in the Sunshine State,” the governor added.

“The new Opportunity Zone program will have a lasting impact for families in the Panhandle by offering tax incentives to attract businesses. This program will grow the local economy, create jobs and provide assistance to hardest-hit areas,” said Cissy Proctor, executive director of the Florida Department of Economic Opportunity.

The federal government will now begin the rulemaking process to designate how Opportunity Funds are created and how businesses, developers and financial institutions can invest in qualified Zones.

Pictured top: The Century Business Center. NorthEscambia.com photo, click to enlarge.

Comments

3 Responses to “Low Tax Opportunity Zones Approved For Escambia County, Including Century”

Every little bit helps but manufacturing(which is what Century needs) wants to locate where there is an abundance of skilled workforce. The town and chamber needs to actively sell century and make a bid for all legitimate businesses to locate here. In the meantime we as a community need to build century from the ground up. Support our small businesses and work to get back all that we have lost in the last twenty years.

A low tax zone is much better than no business’s at all…..something is sure

better than nothing. A job provides much more than just income for employees .

it can be a life saver , a community saver, a Country saver. Work is just a word

but it can provide respect and dignity and well being and it’s omnipotent in life.

Ronald Reagan said economic growth must come from the private sector.

Myself, I think an economy that has to be propped up by the government is a weak economy. They can give all the tax breaks they want, GE pays no taxes and they are still downsizing.

Any American tech innovation immediately goes overseas where it is copied, the advantage of such America never gets a chance to enjoy.