Citizens Insurance May Delay Rate Hike

June 20, 2018

Citizens Property Insurance is poised to delay a 7.9 percent rate increase for policyholders, after some board members suggested Tuesday another rate hike may be too soon following a May 1 increase.

The Citizens Board of Governors, which oversees the government-backed insurer that has some 443,000 policies in the state, will discuss the proposal at its Wednesday meeting in Maitland.

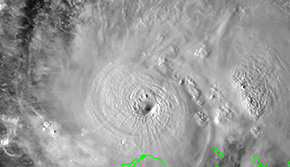

Bette Brown, a consumer representative on the board, asked the Citizens Actuarial and Underwriting Committee on Tuesday to delay action on the annual rate request. She said much of the state, particularly South Florida and the Keys, is still dealing with the aftermath of Hurricane Irma, which hit the state last September.

Bette Brown, a consumer representative on the board, asked the Citizens Actuarial and Underwriting Committee on Tuesday to delay action on the annual rate request. She said much of the state, particularly South Florida and the Keys, is still dealing with the aftermath of Hurricane Irma, which hit the state last September.

“Florida is still in an ongoing emergency, really, recovering,” said Brown, who lives in Monroe County, one of the state’s most heavily damaged areas.

The actuarial committee unanimously adopted Brown’s recommendation, saying the question of the next rate increase will be considered by the full board.

John Wortman, chairman of the actuarial committee, said one possibility would be to delay the 2019 rate increase to next May 1, since a 6.6 percent increase for homeowners with Citizens multi-peril policies took effect last month.

The 2018 rate increase, which normally would have taken effect in February, was delayed until May, following a 90-day rate freeze imposed after Irma.

Under the 2019 rate proposal that will be considered by the board, personal-lines policies for Citizens customers will increase by a statewide average of 7.9 percent, while commercial lines will increase by 8.9 percent.

Personal policyholders include homeowners, condominium-unit owners, renters and mobile-home owners. Commercial lines include condominium associations as well as non-residential property.

Under the rate proposal, inland homeowners with multi-peril policies will face an average increase of 8.3 percent, while coastal homeowners would have a 9.5 percent increase. Wind-only personal-lines policies would increase statewide by 7.8 percent.

Rate increases will vary by county, although the highest increases will be in populous South Florida. Average rates for homeowner multi-peril policies in Miami-Dade County will increase 9.8 percent, with an average annual premium of $3,945. In Broward, rates will increase 9.9 percent on average, with a $3,294 premium.

Wind-only homeowner policies in Monroe County would increase by an average 7.8 percent, with a $3,737 premium.

Pinellas County, which has the third highest total of Citizens multi-peril homeowner policies, would see a 2.8 percent average increase, with a $1,705 premium, according to the proposal.

Rates would decline in a few counties, including Okaloosa, where multi-peril homeowner policies would decrease by an average of 5.5 percent, with a $1,811 premium. But there are only 118 Citizens homeowner policies in that Panhandle community, compared to 54,431 in Miami-Dade.

A factor in the rate increase is the continuing controversy over the “assignment of benefits” practice where property owners with claims assign their insurance benefits to contractors and other firms, which seek reimbursement from the insurance companies. Citizens officials say it leads to increased fraud and inflated claims, while defenders of the practice say it allows property owners to be adequately compensated.

The new rate proposal notes that assignment of benefit claims “are on the rise, particularly in South Florida, and are one of the major factors driving increased non-weather water losses and Citizens’ increased rate need.”

Any rate increase approved by the Citizens Board of Governors is subject to review by the Florida Office of Insurance Regulation. Last year, the board approved a 6.7 percent increase for homeowners’ multi-peril policies but the rate was reduced to 6.6 percent by state insurance regulators.

Citizens annual rate increases are capped at 10 percent under a “glide path” provision in the state law.

by Lloyd Dunkelberger, The News Service of Florida

Comments