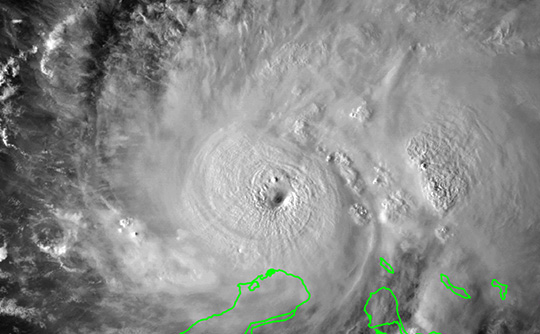

‘Cat Fund’ Healthy Heading Into Hurricane Season

May 24, 2017

The Florida Hurricane Catastrophe Fund is in its strongest financial position ever as the state heads into the annual storm season next month.

But state officials may bolster the fund, which helps private insurers pay claims if Florida gets hit by a major hurricane, with a purchase of $1 billion in private reinsurance.

“We had a sobering reminder last year of the perils that Florida faces every year,” Ash Williams, executive director of the State Board of Administration, told Gov. Rick Scott and the Cabinet on Tuesday.

“We had a sobering reminder last year of the perils that Florida faces every year,” Ash Williams, executive director of the State Board of Administration, told Gov. Rick Scott and the Cabinet on Tuesday.

But with relatively minimal damage from Hurricane Hermine and a fortunate glancing blow from the more-powerful Hurricane Matthew in 2016, Williams said the so-called “Cat Fund” was largely untapped last year, “which means we come into the current season in the strongest financial position we’ve ever been in.”

The 2017 hurricane season starts June 1 and will last through Nov. 30.

The fund has $14.9 billion in cash, with an additional $2.7 billion in funding from “pre-event” bonds. With a total of $17.6 billion, it has more than enough money to pay its potential $17 billion maximum liability.

The fund has grown because it has been able to collect premiums from private insurance companies, which rely on its backup insurance, for more than a decade without having to make a major payout because of the lack of storms.

Given the current funding, Williams said one option would be to “do nothing,” although that brings a certain amount of risk without knowing whether storms will hit the state this year.

“You won’t really know whether what you have done is the right thing until the subsequent season,” Williams said.

However, if Florida is hit by a major hurricane or series of storms, “you would feel awfully good” about having more financial protections in place, Williams told Scott and the Cabinet.

The key option would be buying $1 billion in reinsurance, which would be triggered if storm losses exceeded $10.5 billion. The option would cost approximately $68 million.

Williams said coverage could be purchased without impacting the overall reinsurance market. Private insurers typically buy private reinsurance, along with getting backup coverage from the Cat Fund.

He also said the coverage could likely be purchased at a lower rate than last year and would provide “equal or better terms” for the state.

“Capacity has continued to be ample, and prices have continued to fall,” Williams said about the reinsurance market.

Florida has purchased $1 billion in reinsurance for the Cat Fund the past two hurricane seasons.

Williams said he will test the reinsurance market for a proposal for this year and report back to the governor and Cabinet.

The financial health of the Cat Fund is important because the state can impose a surcharge on most insurance policies, including auto insurance, if the funding is depleted. That happened after the 2004 and 2005 hurricane seasons, with consumers paying a surcharge, also known as a “hurricane tax,” through 2015.

Comments

2 Responses to “‘Cat Fund’ Healthy Heading Into Hurricane Season”

Hope we don’t need it, yes my insurance is 5K deductible if it is a named storm and they are almost all named storms now..won’t be surprised if they try to name afternoon pop up thundershowers…

Well, I would imagine that the insurance companies fund is overflowing with money, Afterall, everyone’s insurance in Florida went up 100’s of percent because of being in good hands or having people on your side. Mine went up 400 per cent. Imagine for 12 years raking in that kind of money from every home and business owner in Florida.So, when a storm does hit, your insurance company, with the help of politicians, have split your policy into so many sections and exempted so many claim issues in favor of SF and NW, as well as all other companies, that now you will have to pay out a good percentage of the claim up front and higher deductibles. I suspect that the cash cows they have brought in over the last 12 years will hardly be touched. We are no longer the Sunshine State but thanks to the insurance companies, we are the state where the sun doesn’t shine. Tell me if I am wrong!