Escambia Offering $12,500 Homebuyer Assistance In CRAs

June 9, 2016

Escambia County and the city of Pensacola announce the availability of down payment and closing cost assistance of up to $12,500 for homebuyers purchasing new homes in county or city Community Redevelopment Areas through the HOME Program. Buyers must make the property their principal residence. Assistance is provided in the form of a five-year loan, forgivable at the end of the loan term provided that the buyer does not sell, rent or transfer the property within that time frame. Funding is available on a first qualified, first served basis.

Buyer qualifications for HOME Homebuyer Program:

- Have a total gross family income that does not exceed 80 percent of area median income for Escambia County adjusted for family size.

- Have sufficient income and credit worthiness to qualify for primary financing from a participating lender.

- Must attend a free eight-hour HUD certified homebuyer class offered by Community Enterprise Investments Inc., (850) 595-6234, or Consumer Credit Counseling Services, (850) 434-0268, prior to closing.

For a map of Escambia County CRAs, click here.

For a map of city of Pensacola CRAs, click here.

For more information, contact Tracy Pickens at (850) 858-0350, option 8.

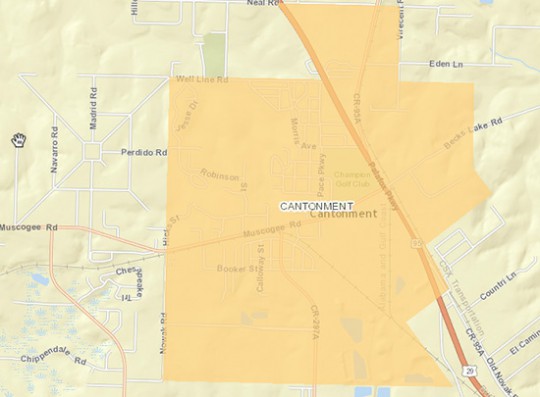

Pictured: The Cantonment CRA.

Comments

15 Responses to “Escambia Offering $12,500 Homebuyer Assistance In CRAs”

There are still several historic homes in Century on Jefferson that don’t look damaged by the tornado. I hope the CRA will be formed now that the town council has district 5 and Steve Barry said he offers his staff to help. Now a new school is coming in and even FDOT may be doing highway work through there. The property taxes are low now and will improve. I believe someone can use this and things start to turn around for the area. I know you need five people working on the council and elections are coming up. Hopefully the town takes advantage of these opportunities and not let them slip away.

I had help with closing cost and down payment when I purchased my first home! I am still a home owner at the same house. I have never been late on a mortgage payment. I also do my own yard work and I buy my filters from walmart. I also had to replace the furnace and ac unit. I was also a single mother. It is possible and not every one who needs help forecloses. It is nice that they offer help and give other the chance to own a home. I love being a home owner and be able to pain the colors I want and not have to answer or deal with landlords or tenants. Great investement and helps your credit.

Wow–there’s a lot of misinformation on this thread regarding this program, eligibility for family members to gift money for a downpayment (for many loan products), and the inaccuracy regarding those that get loans requiring $0 down being “unqualified” to be able to make monthly payments. There are MANY people that fulfill their loan requirements after receiving $0 down loans–for instance VA borrowers, many USDA loans, and others. Don’t assume that just because one doesn’t have the cash available (3%-20%+) to put down for the down payment means they can’t afford the loan payment or will default. Lenders are being VERY careful about lending money. No, I’m not a lender at all, but I am a real estate agent and see the process lenders are using to qualify buyers. It’s not easy–even with programs such as this. So, if there’s a loan product out there that can help someone get in a home, I think that’s great news!!

(Regarding a housing crash? That’s not been in any forecast reports I’ve seen within the industry.)

Oh,and add another $25.00 per year to your taxes,fire tax will now be $125 annualy

when we bought our home in M/G the firefighters were all volunteers,now paid thankfully(and they do an outstanding job!)but in 1985 our taxes were if I remember somewhere around $15.00 a year……oh well…..future wannabee homeowners would be better suited to buy a small parcel of rural land (owner financed) with low down,and payments they could afford,then buy a fixer-up’ mobile home to move on the property to live in while saving for a nice home or build on their lot….paid in steps as they could afford…

to all the naysayers:

Are you paying rent? Have you even investigated how much it costs to rent a house?

With interest rates still very low, the cost of owning vs renting can be in the hundreds of dollars each month–enabling the owner to buy those all-important AC filters.

FYI Jon: Rents are higher than mortgage payments. Everywhere. Why do you think there are so many rental houses?

Also, why would you assume that just because a family cannot save up thousands of $$$$ for a down-payment that they’re high-risk for a mortgage lender? Plenty of people pay bills on time yet have next to nothing left over.

In addition, these home buyer assistance programs target certain areas, and those areas are improved–by not having the majority of residents there being transient renters.

How do I know all this? Because I took advantage of Escambia county/State of FL’s SHIP back in Y2K to buy my first house. Without that First-Time Buyers downpayment assistance, it could not have happened, despite a long history of good credit and stable employment. Having to attend the class on home-buying as a prerequisite for getting the funds was very informative.

I still own that house, and rent it out at a small profit. I also own the place I live in now, and another property, bought without outside assistance.

People should certainly consider taking advantage of this opportunity!

Actually this is a great program.

It allows a lot of landlords to get rid of rental houses that are money pits.

As Jon stated if you can’t afford the down payment you can’t afford to buy period.

Now add in insurance(must have with any loan) yearly taxes, annual termite bond renewal,little things like replacing a/c filters monthly,smoke alarm batteries twice a year,yard maintenance pay someone or buy the gear?Not trying to be pessimistic however it’s factual that 75% of habitat for homes buyers are foreclosed within 2 years and the buyers miss their “low income” rental payments…these are gritty truths and no government “loan” is going to make you a homeowner if you can’t afford to buy.

The real problem here is the fact that they limit the income of the buyers to 80% of the median income. I can promise you this. Most families with an income that is only 80% of the median family income of this area cannot afford and should not be buying a house. That’s just simply math and good economics. If a person does not have this cash for down payments in the first place, they will not be able to afford the monthly mortgage. I can almost say this with certainty. I have had a few people I know take advantage of programs such as these to get into a home. Only to have the house go back to the bank after the home insurance and taxes are raised over a few years and they can’t afford it anymore.

Quit trying to inject artificial homeowners into the housing market! Let’s face it, if you cannot afford it without government assistance, you can’t afford it period! It’s not a bad thing per se. But don’t get caught up in the “own your own home” dream if you cannot afford it yet. There are a lot of costs that these programs do not tell you about. Home insurance being one of them! Most people will get a very low rate initially when they purchase a home for insurance. But they find that within the first 5 years or so, their rates rise. Then they cannot afford it anymore because they barely could afford the house in the first place. Not too mention, more than likely the houses in these areas are not brand new homes. So most are going to need quite a bit of maintenance and upkeep that most of these owners are not willing to or cannot afford to do on the homes. Then all it takes is one AC system to go out, or the roof to need replaced and boom, back to the bank it goes!!!!

I’ve seen it way too many times over and over again!!!!

I wonder how this will work with regular lenders?

Most down payments must be in cash and not from some other type of loan.

Not even a loan from Mom and Dad.

http://www.northescambia.com/2016/02/century-approves-formation-of-community-redevelopment-area

Thanks, so they approved it but haven’t followed through I suppose. No time like the present to get to work. Thanks for the update.

>>Why is the CRA that Century voted to form not on this map?

Century never completed the process. They had several meetings to discuss a possible CRA, but one was never formed.

Why is the CRA that Century voted to form not on this map? Is there one in Century and does this program apply? Please update the status on that CRA. Is it formed and in place? Did the town council follow through and are they working on that after they voted to do it?

So, John, you would rather people continue to be unable to buy a home cuz of all that govt meddling?.Cuz that way more logical than helping someone actually have a place to call their own. There is an abundance of empty homes this town…I see no problem with this program. Are you sure you meant realtor? Sounds more like a psychic to me…

More government meddling in the housing economy, I have a friend who is in real estate, he says another crash is coming, maybe in less than five years.