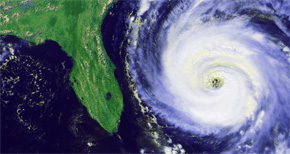

Nine-Day Hurricane Sales Tax Holiday Now Underway

May 31, 2014

Florida’s nine-day Hurricane Preparedness Sales Tax Holiday begins this weekend.

Florida’s nine-day Hurricane Preparedness Sales Tax Holiday begins this weekend.

From May 31 to June 8, numerous items often purchased to prepare for hurricanes will be tax free:

Qualifying Items

Selling for $10 or less:

• Reusable ice (reusable ice packs)

Selling for $20 or less:

• Any portable self-powered light source

• Battery-powered flashlights

• Battery-powered lanterns

• Gas-powered lanterns (including propane, kerosene, lamp oil, or similar fuel)

• Tiki-type torches

• Candles

Selling for $25 or less:

• Any gas or diesel fuel container (including LP gas and kerosene containers)

Selling for $30 or less:

• Batteries, including rechargeable batteries and excluding automobile and boat batteries

(listed sizes only)

• AA-cell

• C-cell

• D-cell

• 6-volt

• 9-volt

• Coolers (food-storage; nonelectrical)

• Ice chests (food-storage; nonelectrical)

• Self-contained first-aid kit (already tax exempt)

Selling for $50 or less:

• Tarpaulins (tarps)

• Visqueen, plastic sheeting, plastic drop cloths, and other flexible waterproof sheeting

• Ground anchor systems

• Tie-down kits

• Bungee cords

• Ratchet straps

• Radios (self-powered or battery-powered)

• Two-way radios (self-powered or battery-powered)

• Weather band radios (self-powered or battery-powered)

Selling for $750 or less:

• Portable generators that will be used to provide light, communications, or to preserve food in the event of a power outage

Note: Eligible battery-powered or gas-powered light sources and portable self-powered radios qualify for the exemption even though they may have electrical cords.

Comments