Dream Defenders Return, Call Capitol Access Rule ‘Ridiculous”

September 24, 2013

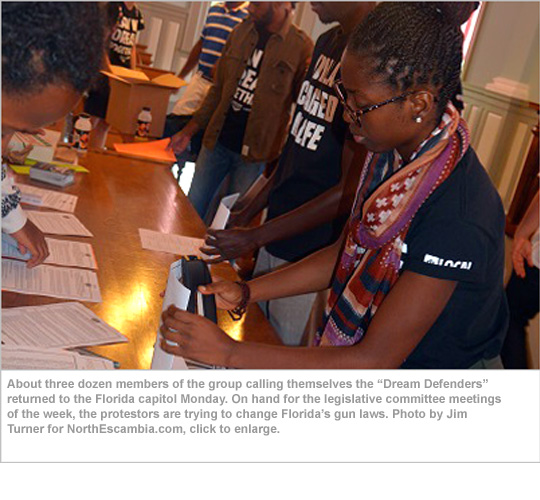

The Dream Defenders, a group that held a month-long summer encampment outside the governor’s office, returned to Tallahassee on Monday and called a proposal to limit after-hours access to the Capitol a “ridiculous” stifling of the public’s right to free speech.

However, the Hialeah-based group intends to remain focused on the difficult task of changing laws about self-defense and racial profiling rather than contesting the Florida Department of Law Enforcement’s proposal, which would try to spur the public to leave the Capitol by 5 p.m. on weekdays or within 30 minutes of the end of public meetings.

Those who don’t leave when requested could face trespassing charges.

FDLE spokeswoman Gretl Plessinger said Monday afternoon the agency continues to await approval or comment from the offices of the governor, the Senate president and the House speaker.

Dream Defenders Legal and Policy Director Ahmad Abuznaid said Monday that the proposed rule is a danger to free speech and the right to assemble.

“We feel like if we were big money and had millions of dollars to come voice our opinion to the legislators this wouldn’t be a problem,” Abuznaid said.

The stated purpose of the rule is to enable the police to better secure the Capitol complex.

The FDLE proposal would also prohibit people from staying overnight or preparing food in publicly accessible parts of the building. There would also be additional restrictions on people who have access cards to the building and how many other people who would be allowed to accompany them.

The Dream Defenders held a 31-day sit-in inside the Capitol from July 16 to Aug. 15, arriving after the acquittal of George Zimmerman in the 2012 shooting death of teen Trayvon Martin in Sanford.

The FDLE has estimated the around-the-clock protest ran up a tab of $505,248 for Capitol police. The total included regular pay plus overtime, which has been put at $172,592.

“It’s a little ridiculous,” said Dream Defenders Political Director Ciara Taylor. “We’re asking for FDLE to look into discrimination, to take a deep look at racial profiling and how law enforcement connects with black and brown people across the state, and it seems like they don’t have time to do that. But they do have time to come up with a rule against taxpaying citizens of this state, basically making the Capitol inaccessible.”

The sit-in drew a steady stream of visitors, including entertainer and civil-rights veteran Harry Belafonte and rapper Talib Kweli. Another visitor was longtime activist Jesse Jackson, who touched off his own media storm by claiming that Florida practiced apartheid and comparing Gov. Rick Scott to segregationist Alabama Gov. George Wallace.

The Dream Defenders spent Monday afternoon training about 40 members in the Old Capitol about how to lobby legislators, who are in Tallahassee this week for the first committee meetings leading up the 2014 session.

The group remains hopeful that lawmakers will advance proposals, beyond a one-day House hearing on the “stand your ground” law that is expected in October.

Several already-filed bills are directed at the law, with a proposal (SB 130) by Sen. David Simmons, R-Altamonte Springs, expected to have the best chance to advance.

Simmons’ proposal would require local law enforcement to issue “reasonable” guidelines for the operation of neighborhood watch programs. Zimmerman was a neighborhood-watch volunteer when he shot Martin during an altercation.

The bill closely matches part of a broader proposal (SB 122) that Senate Minority Leader Chris Smith, D-Fort Lauderdale, filed to address the “stand your ground” law.

Century Approves Budget With $1.6 Million Increase, Sets Tax Rate

September 24, 2013

Monday afternoon, the Century Town Council voted to adopt a budget that was up about 50 percent over last year and set the tax rate for the upcoming 2013-14 fiscal year.

The proposed 2013-2014 budget is$4,384,791, up about $1.6 million over the last fiscal year. The operating budget increase is due to grant income and associated expenditures of $1,595,000 — including a $650,000 housing grant and a $944,000 drainage project grant for North Century Boulevard.

There will be no net increase in ad valorem taxes this year to meet the budget for fiscal year 2013-2014, which begins October 1. The recomputed millage rate of .9006 is equal to and does not exceed the rolled-back rate.

To view a summary of the budget in pdf format, click here or the image below.

Red Snapper Season Opening

September 24, 2013

The recreational harvest of red snapper will open Oct. 1 in state and federal waters of the Gulf of Mexico. In state waters, which are from shore to 9 nautical miles in the Gulf, the season will remain open through Oct. 21, closing on Oct. 22. In federal waters, which are from 9 nautical miles out to 200 nautical miles, the season will remain open through Oct. 14, closing on Oct. 15.

These supplemental recreational red snapper seasons are for 2013 only. The minimum size limit in state and federal waters is 16 inches, and the daily bag limit is two per harvester, per day. There is a zero daily bag and possession limit for captain and crew on for-hire vessels.

Anglers are required to use circle hooks and dehooking devices when fishing for any reef species, including red snapper, in Gulf of Mexico state and federal waters. The requirement to use venting tools in federal waters was removed on Sept. 3. The Florida Fish and Wildlife Conservation Commission will consider adopting similar changes at a future meeting. The intent of these rules is to help conserve fishery resources by increasing the chances for a fish to survive after being caught and released.

Learn more about red snapper by visiting MyFWC.com/Fishing and clicking on “Saltwater” and “Recreational Regulations.”

One Injured In Pine Forest Crash

September 23, 2013

One person suffered minor injuries in a two vehicle accident Monday morning on Pine Forest Road.

According to the Florida Highway Patrol, 18-year old Jordan Dustin Michael Rowell of Pensacola pulled out of a Nine Mile Road business onto Pine Forest Road and into the path of a northbound 2006 Ford Expedition driven by 62-year old Randall Ray Bell of Pensacola.

Rowell received minor injuries and was transported to Sacred Heart Hospital. He was also cited by the FHP for failing to yield when making a left turn. Bell was not injured.

Reader submitted photo by Sarah Tipton for NorthEscambia.com, click to enlarge.

Man Busted After Skipping Court On Charges He Fired Rifle At Couple

September 23, 2013

A Century man is back behind bars after failing to show up in court on charges that he opened fire near an older couple alongside a highway in the Christian Home community in late January.

Akino Jama Jackson, 20, was arrested on an outstanding failure to appear warrant and booked into the Escambia County Jail without bond. According to court records, he was due in court for a hearing on July 2 but failed to appear.

Akino Jama Jackson, 20, was arrested on an outstanding failure to appear warrant and booked into the Escambia County Jail without bond. According to court records, he was due in court for a hearing on July 2 but failed to appear.

Jackson was charged with aggravated assault with a deadly weapon without intent to kill, firing a weapon in public, and possession of a weapon by a convicted felon for a January 29 incident on Highway 164 near Pine Barren Road.

Escambia County Sheriff’s Office investigators said a husband and wife were picking up cans from the shoulder of the road when a vehicle stopped and Jackson exited, armed with a semi automatic rifle.

He confronted the couple, reportedly demanding that they return his property — drugs that were allegedly tossed at the location from a passing vehicle earlier in the day. Jackson then fired the rifle “into the ground several times in the vicinity of the victims” before fleeing in the vehicle, according to an Escambia County Sheriff’s Office arrest report. No one was struck by the gunfire, and there were no injuries.

The couple then drove about six miles to their home before calling for help. Deputies recovered multiple shell casings alongside Highway 164, consistent with the couple’s story. Jackson was positively identified by one of the victims.

Pictured: An Escambia County Sheriff’s Office investigator January 29 at the scene of a shots fired incident along Highway 164 near Pine Barren Road. NorthEscambia.com file photo, click to enlarge.

Middle Schools To Hold Open House Events Tuesday Evening

September 23, 2013

Open house events will be held at Tuesday evening at middles schools across Escambia County.

Ernest Ward Middle School open house will be Tuesday, September 24 beginning at 6 p.m. Due to construction, all parents should park in front of the administration building and in front of the bus ramp.

Ransom Middle School will hold open house on Tuesday, September 24 from 6-7:30 p.m.

For more information, contact your child’s school.

Escambia Declared Natural Disaster Area Due To Rain, Flooding

September 23, 2013

Escambia counties in Florida and Alabama have been declared natural disaster areas due to damages and losses caused by excessive rain and flooding that began January 1, 2013, and continues.

The U.S. Department of Agriculture (USDA) has designated 50 counties in Alabama as the primary natural disaster areas. Farmers and ranchers in Escambia County in Alabama and Escambia County in Florida qualify for natural disaster assistance because their counties are contiguous.

“Our hearts go out to those Alabama farmers and ranchers affected by recent natural disasters,” said Agriculture Secretary Tom Vilsack. “President Obama and I are committed to ensuring that agriculture remains a bright spot in our nation’s economy by sustaining the successes of America’s farmers, ranchers and rural communities through these difficult times. We’re also telling Alabama producers that USDA stands with you and your communities when severe weather and natural disasters threaten to disrupt your livelihood.”

All qualified farm operators in the designated areas eligible for low interest emergency (EM) loans from USDA’s Farm Service Agency (FSA), provided eligibility requirements are met. Farmers in eligible counties have eight months from the date of the declaration to apply for loans to help cover part of their actual losses. FSA will consider each loan application on its own merits, taking into account the extent of losses, security available and repayment ability. FSA has a variety of programs, in addition to the EM loan program, to help eligible farmers recover from adversity.

Additional programs available to assist farmers and ranchers include the Emergency Conservation Program, Federal Crop Insurance, and the Noninsured Crop Disaster Assistance Program. Interested farmers may contact their local USDA Service Centers for further information on eligibility requirements and application procedures for these and other programs. Additional information is also available online at http://disaster.fsa.usda.gov.

Pictured above and below: Taking advantage of a dry day, a crop duster is used to apply pesticides to a corn field in Walnut Hill. NorthEscambia.com photos, click to enlarge.

Clayton Graduates From Basic Combat Training

September 23, 2013

Army Pvt. Jacob A. Clayton has graduated from basic combat training at Fort Jackson, Columbia, S.C.

During the nine weeks of training, the soldier studied the Army mission, history, tradition and core values, physical fitness, and received instruction and practice in basic combat skills, military weapons, chemical warfare and bayonet training, drill and ceremony, marching, rifle marksmanship, armed and unarmed combat, map reading, field tactics, military courtesy, military justice system, basic first aid, foot marches, and field training exercises.

Clayton is the son of Brenda Garrett-McCall of Highway 95A, Molino, and grandson of Larry Garrett of Mobile, Ala.

He is a 2011 graduate of Northview High School in Bratt.

Citizens Property Expects To Drop Below 1 Million Policies

September 23, 2013

The state-backed Citizens Property Insurance Corp. may drop below 1 million policies for the first time since 2005, while its employees could start to occupy fewer buildings in the coming year.

Citizens, which stood at a bloated 1.5 million policies a little more than a year ago, could be around 600,000 policies before the next storm season approaches.

However, Citizens President and CEO Barry Gilway said a more reasonable number would be just over 900,000.

However, Citizens President and CEO Barry Gilway said a more reasonable number would be just over 900,000.

Gilway credited the pending reduction to recent takeout efforts by private companies and to the anticipation of using a new clearinghouse to help direct what are expected to be many of the least-risky policies into the private market.

“The difference in the entire makeup of Citizens in the last 14 months is staggering,” Gilway said during a board meeting that mostly focused on informational updates.

Gilway was brought onto Citizens from Seattle-based Mattei Insurance Services in June 2012 as Citizens was under fire for its role as the state’s largest property insurer.

As of Aug. 31, Citizens had nearly 1.23 million policies, according to the most recent number posted on the company’s website. Gilway said the number was now closer to 1.2 million.

Nearly 400,000 Citizens policyholders will be told during the next month that they will have to decide whether they want to remain with the state-backed insurer or be shifted to one of 10 private carriers that were approved in August for a massive takeout program.

Gilway said he expects seven or eight companies to request taking out an additional 200,000 policies in December.

In each case, the private carriers must agree not to change the terms of policies until it is time for policies to be renewed.

Citizens estimates that 30 percent to 35 percent of those offered the move to the private market will remain with the state-backed insurer when the initial offers are made.

Lisa Miller, a former deputy insurance commissioner who now lobbies for insurers, said the reduction should be good for all Floridians.

“This means more options for consumers because companies will compete — compete on price, service and coverage,” Miller said.

Sam Miller, executive vice president of the Florida Insurance Council, said the reduction of Citizens will make the rest of the insurance market in Florida stronger. But, he added that Citizens, which was under 300,000 policies a decade ago, still has a ways to go.

“We believe Citizens should not compete with private insurers who are writing at rates approved by the Office of Insurance Regulation and that coverage should be written on the private market whenever it is available, again at rates regulated by the state,” Sam Miller said in an email.

He added that while statewide assessments may still be necessary following a major hurricane, the totals will be less.

With the trimming of policies, and as Florida is in the midst of an eighth consecutive season of having no major hurricane make direct landfall, Citizens’ unfunded liability risk from the impact of a one-in-100-year-storm has dropped from $10 billion to $4 billion, Gilway said.

“And that does not contemplate the 600,000 requests for depopulation,” Gilway said.

With the leaner number of policies, and as the company internally undergoes a massive reorganization, the state-backed insurer is also looking to scale back on its facilities used to house approximately 1,120 employees.

Collectively, the nine properties cost $525,894 a month in leases. The total does not include operational costs.

Gilway said the agency is undertaking a review of four offices in Jacksonville, four in Tallahassee and one in Tampa for the potential of consolidation and to reduce lease costs.

“We probably do need one location in each,” Gilway said. “Looking at the lease rates, we’re designing strategies to consolidate locations.”

Citizens spends $270,818 a month to rent space in the Corporate Center, Cypress Plaza, The Point and on Nations Way in Jacksonville.

Citizens already plans to move out of Monroe Park Tower in Tallahassee, which costs $11,218 a month, by the end of the year. The remaining locations in Tallahassee, at Citizens Centre I, Citizens Centre II and the Killearn Center, collectively cost $129,146.

Meanwhile, Yong Gilroy, Citizens chief insurance officer, told the board the clearinghouse, which lawmakers approved this year, remains on pace to begin Jan. 1.

Last month, the Citizens board approved a contract that could be worth up to $44.9 million over a decade with Bolt Solutions, Inc., to provide a software platform for the clearinghouse.

The clearinghouse is designed to match up homeowners with private insurance companies willing to provide coverage.

Consumers, working with their agents, will submit information, and insurance companies then will be able to make coverage offers.

Sen. Tom Lee, R-Brandon, has requested that additional warnings be clearly placed on the takeout offers.

by Jim Turner, The News Service of Florida

Realtors: Local Home Sales On The Upswing

September 23, 2013

Single-family home sales across Florida grew 12.5 percent in August compared to the same period a year earlier, the Florida Realtors reported Thursday, with the local market expanding at almost twice that rate.

In the Escambia-Santa Rosa market, new home sales were up 22.6 percent in August over last year, while local condo and townhouse sales were up 6.1 percent. The average home sale price in Escambia and Santa Rosa counties was up 4.7 percent from last year to $157,000.

In the Escambia-Santa Rosa market, new home sales were up 22.6 percent in August over last year, while local condo and townhouse sales were up 6.1 percent. The average home sale price in Escambia and Santa Rosa counties was up 4.7 percent from last year to $157,000.

The Realtors reported there were 20,933 sales closed statewide on existing single-family homes last month. The median sales price for single-family homes was $175,000, up 18.6 percent from a year earlier. That was down from the $179,500 median price on the 20,632 single-family homes that were sold statewide in July. The median sales price on single-family homes nationwide, based upon July numbers, is $214,000, up 13.5 percent from the prior year.