ACLU, Dept. Of Corrections Settle Public Records Lawsuit

November 21, 2013

The American Civil Liberties Union of Florida and the state Department of Corrections have settled a legal dispute about records dealing with inmate housing at Santa Rosa Correctional Institution in the Panhandle.

The ACLU filed a lawsuit in August against the department, claiming the agency had rejected public-records requests that involved computerized information about housing assignments and cell or bunk assignments.

The ACLU filed a lawsuit in August against the department, claiming the agency had rejected public-records requests that involved computerized information about housing assignments and cell or bunk assignments.

But in a settlement dated Monday, the department agreed to provide in an electronic format any number of “bed run” reports requested by the ACLU. Also, the state agreed to pay $4,000 in legal fees and costs.

In a prepared statement Wednesday, ACLU attorney Benjamin Stevenson said the settlement “signals a policy change. The department should no longer refuse the ACLU or any other Floridian’s request to extract public information from its databases.”

Florida, Local Housing Market Continue Positive Growth

November 21, 2013

Florida’s housing market continued its upswing in October 2013, as did local Escambia and Santa Rosa county single home sales, according to Florida Realtors.

Statewide closed sales of existing single-family homes totaled 18,728 in October, up 6.5 percent compared to the year-ago figure. Closed sales typically occur 30 to 90 days after sales contracts are written.

Statewide closed sales of existing single-family homes totaled 18,728 in October, up 6.5 percent compared to the year-ago figure. Closed sales typically occur 30 to 90 days after sales contracts are written.

In Escambia and Santa Rosa counties, sales of single family homes were up 6.2% over last year with 477 sold at an average price of $152,000. Overall, single family home sales are up 8.6% locally over last year. Sales of condos and townhouses are down overall by 25% this year compared to last.

Image courtesy Florida Realtors for NorthEscambia.com, click to enlarge.

FWC Approves Draft Plan With New Deer Hunting Regulations For Northwest Florida

November 21, 2013

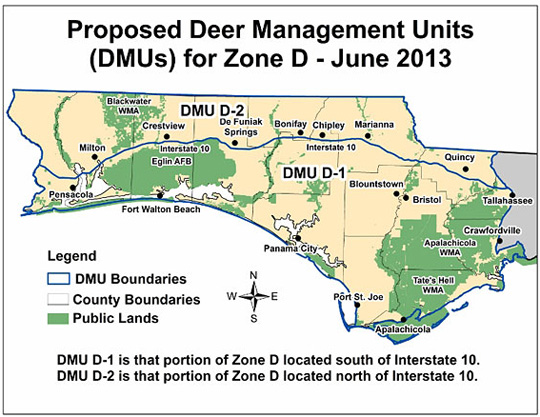

The Florida Fish and Wildlife Conservation Commission approved a draft proposal Wednesday that would divide the state’s Hunting Zone D (from Pensacola to Tallahassee) into two deer management units (DMUs), each with its own unique set of deer antler-point regulations and antlerless deer harvest days.

These proposals for Zone D, which if passed at the April 2014 Commission meeting, would take effect during the 2014-15 hunting season and are part of a larger, statewide project aimed at managing deer on a more local level and providing stakeholders with a greater say in deer management. The Commission also directed staff to provide an update on this issue at the February Commission meeting.

The FWC conducted a public outreach and input process in northwest Florida during the first three months of 2013. During that period, the Commission received input and comments from hunters, farmers and the general public regarding how they would like to see deer managed in the newly proposed DMUs.

The FWC conducted a public outreach and input process in northwest Florida during the first three months of 2013. During that period, the Commission received input and comments from hunters, farmers and the general public regarding how they would like to see deer managed in the newly proposed DMUs.

As a result of this outreach process, the FWC is considering rule proposals for both public and private lands in both of the DMUs in Zone D, specifically north and south of Interstate 10. Currently statewide on private lands and most wildlife management areas, bucks that are legal to take must have at least one antler that is at least 5 inches long.

The proposals would require that bucks harvested north of I-10 in Hunting Zone D have antlers with at least three points (each point having to be at least 1 inch long) on one side. South of I-10 in Zone D, the minimum antler requirement would be two points on one side.

The proposal includes an exception to the antler requirements in both DMUs whereby youth 15 years old and younger may continue to harvest bucks with at least one antler that is 5 inches or more in length.

Also, the FWC is proposing a change to the antlerless deer season (“doe days”) on private lands within Zone D. Currently in that zone, the season to take deer of either sex (except spotted fawns) runs for seven consecutive days: Dec. 26 – Jan. 1. In the proposed rules, those dates north of I-10 would change to eight days distributed across four weekends (Saturday-Sunday after Thanksgiving, first weekend of muzzleloading gun season, third weekend of general gun season and the weekend after Christmas).

South of I-10, in Zone D, the proposal would change the antlerless season to four days consisting of two popular holiday weekends (the weekends after Thanksgiving and Christmas).

The purpose of modifying the antlerless deer season, the FWC said, is to spread out the hunting opportunity, so that more hunters may be able to participate without substantially reducing deer populations. These changes would be monitored to measure the impact on the deer harvest and hunter satisfaction within each DMU.

Century Signs Off On $742 Million Bond Issue; Town Could Earn $260K

November 21, 2013

The town of Century has approved 14 separate financing proposals totaling nearly three-quarters of a billion dollars, potentially earning about $260,000 for the town as a member of a partnership with Gulf Breeze.

The approval was granted by Century and Gulf Breeze as members of the Capital Trust Agency, an independent public body for the purpose of financing or otherwise accomplishing development programs. Century entered into the Capital Trust Agency with Gulf Breeze in 1999 with Century essentially serving as the “second signature” for CTA.

The approval was granted by Century and Gulf Breeze as members of the Capital Trust Agency, an independent public body for the purpose of financing or otherwise accomplishing development programs. Century entered into the Capital Trust Agency with Gulf Breeze in 1999 with Century essentially serving as the “second signature” for CTA.

To date — before any fees are received from the latest round of bonds — Century has earned $605,223.47 since the inception of CTA.

Within the 14 financing approvals granted this week, there are 26 separate housing projects across the state in cities that include St. Augustine, Ft. Lauderdale, Melbourne, New Smyrna Beach and Jacksonsville. The projects include a total of 2,668 housing units for which $742,500,000 worth of bonds were authorized. If all of the bonds were to to be issued, the fees for the Town of Century would be $259,925.

But Matt Dannheisser, attorney for CTA, Century and Gulf Breeze, said it is unlikely that all of the bonds would be issued.

“It is too early in the process to have a good idea of the exact financial needs for each project. Remember, that all but one are contingent upon receiving private activity bond allocations,” Dannheisser said.

Dannheisser said that the CTA is structured in such a way to indemnify Century from any financial risk, whether it be from a company that defaults on repayment or any other legal liabilities. None of the bond funds actually originate from the coffers of Century or Gulf Breeze.

For serving as the second signature for CTA, Century is paid $350 per $1 million financed with a$2,500 minimum fee.

Scott Honors Two Escambia Teachers With ‘Shine’ Awards

November 21, 2013

During Tuesday’s meeting of the Florida Cabinet, Gov. Rick Scott recognized five educators who formerly served in various branches of the military with the Governor’s Shine Award for their service to our country and their contributions to Florida’s students.

“It is an honor to thank these teachers who went from serving their country to serving Florida students in the classroom. A great education system is key to creating a highly-skilled workforce and driving our economy forward. These teachers have gone above and beyond the call of duty by preparing our students today for the jobs of tomorrow, and I thank them for their continued service to Florida families,” Scott said.

The Shine Award is presented to Floridians who have positively impacted children through education.

Two Escambia County teachers received the Shine award Tuesday from the governor:

Glenn Meyer, U.S. Air Force, Navy Point Elementary – Meyer served in the United States Air Force for 21 years before retiring at NAS Pensacola in November 2009. His last 11 years of service were in education and training commitments. Meyer began his teaching career in 2009 and has since taught 5th and 2nd grades at Pleasant Grove Elementary School. He now teaches 5th grade at Navy Point Elementary School in Pensacola.

Katherine Stefansson, U.S. Navy, Bellview Middle School – Stefansson retired from the United States Navy as a Public Affairs Officer and went on to receive her Master’s degree in Education. She taught in three different elementary schools before moving to Bellview Middle School in Pensacola where she now teaches 8th grade American History. Her favorite part of teaching is helping students learn how to make connections between what they learn in class and how it can affect their daily lives.

Crime In Florida, Escambia County Down For First Half Of 2013

November 21, 2013

Crime was generally down during the first half of 2013 in Florida and Escambia County when compared to the first half of 2012, according to the 2013 Semi-Annual Uniform Crime Report released Wednesday by the Florida Department of Law Enforcement.

Crime was generally down during the first half of 2013 in Florida and Escambia County when compared to the first half of 2012, according to the 2013 Semi-Annual Uniform Crime Report released Wednesday by the Florida Department of Law Enforcement.

During the report period, murders were up by one in Escambia County from 10 in 2012 to nine in 2013. Nine of those 10 murders were in the jurisdiction of the Escambia County Sheriff’s Office; one was in the Pensacola Police Department jurisdiction.

Most other major crimes were down in Escambia County during the first half of this year as compared to the first half of 2012:

- Forcible Rape decreased 33% from 126 to 84

- Robberies were almost unchanged with 242 in 2012 and 243 in 2013

- Aggravated Assaults were down 8.5% from 894 to 818

- Burglaries were down 11% from 1,798 to 1,599

- Larceny was down 9% from 5,222 to 4,752

- Vehicle thefts were up 12% from 357 to 400

The overall crime index decreased by 8.7% when comparing the first half of 2012 to the first half of 2013.

Editor’s note: The Escambia County crime stats include crimes reported in the jurisdictions of the Escambia County Sheriff’s Office, Pensacola Police Department, University of West Florida Police Department and Pensacola State College Police Department.

Tax Cuts And Tax Holidays Would Save Shoppers, Businesses Millions

November 21, 2013

A nearly two-week hurricane preparedness tax holiday, in which sales tax would be lifted on select storm related gear, would save shoppers at least $3.3 million, state economists said Wednesday.

Meanwhile, a separate measure expected to also go before state legislators in 2014, the popular three-day back-to-school sale tax holiday on select clothes, supplies and electronics, would keep about $35.9 million from flowing into state and local government coffers, analysts said.

State economists, sitting as the Revenue Estimating Conference, reviewed the proposed sales tax breaks on Wednesday, along with separate measures to reduce the corporate income, communications-services, and the commercial rental taxes all filed by Senate Finance and Tax Chairwoman Dorothy Hukill, R-Port Orange.

The proposed business tax and fee reductions, along with the sales tax holidays, are just some of the proposals that have come in the wake of Gov. Rick Scott’s request for lawmakers to cut $500 million in fees and taxes.

A big factor in how much of the cuts or tax holidays make it into the next fiscal plan depends in part on the state’s economic outlook that the economists will update prior to the legislative session early next year.

“We will update it and readopt it probably in early January,” Amy Baker, the Legislature’s chief economist, said of the proposed tax cuts. “But you wouldn’t expect the numbers to change.”

The overall budget forecast has lawmakers preparing a fiscal plan with an $845.7 million surplus from the current year. The state’s September revenue report indicates that general tax collections remain 7.2 percent ahead of projections for the current year.

The panel estimated that Hukill’s proposed 2 percent cut in the state’s communications-services tax (SB 266) would reduce state revenue by $255 million, a slight deviation from the lawmaker’s initial estimate of $282 million a year.

The complicated tax affects a number of communications services, with Hukill pointing to examples such as cell phones.

The economists also projected that Hukill’s proposal (SB 176) to reduce a commercial rental tax from 6 percent to 5 percent would cut state revenue about $235.6 million, and local revenue by $20.2 million in its first year. The business savings would grow to around $300 million in revenue reductions for the state and $25.8 million in reduced income for local governments by the 2018 fiscal year.

Hukill had initially estimated that the reduction would cut $250 million a year from state revenue.

Meanwhile, Hukill’s proposal (SB 134) to increase the amount of income exempt from the corporate income tax, from $50,000 to $75,000, would reduce state revenue by about $22 million a year, the economists projected.

The hurricane holiday measure (SB 362) by Sen. Rob Bradley, R-Fleming Island, would lift sales tax on select gear from June 1 to June 12 if approved by the Legislature and signed into law by Scott.

Items that would be free of the sales tax during the period would include: flash lights and other self-powered lights selling for $20 or less; portable self-powered radios, two-way radios, or weather band radios that sell for $50 or less; tarps or other flexible waterproof sheeting that sells for less than $50; first-aid kits that cost under $30; packets of AA, C, D, 6-volt, and 9-volt batteries that sell for under $30; and portable generators worth less than $750.

Baker said the $3.3 million revenue reduction projection may be low.

The projection was difficult because it’s hard to project how many people would actually buy the supplies during the tax break period. Many Floridians already have them around the house as part of hurricane kits.

As for the back to school holiday, the overall $35.9 million projection is up from a $28.3 million hit to the state economy, and $6.4 million impact to local governments from the holiday this past year. Shoppers got more tax savings this past August than in the past due in part to the inclusion for the first time of computers and related accessories under $750 into the discounted items.

Baker said future back-to-school holiday projections should be expected to grow as students become even more tech savvy.

The back-to-school sales tax proposal has yet to be filed as a bill.

House Finance and Tax Chairman Ritch Workman, R-Melbourne, has said he may revive a failed proposal from the 2013 session that would exchange revenue generated from collecting sales taxes on Internet purchases for an extended back-to-school sales tax holiday.

Rather than a three-day tax holiday on clothing and school items, Workman said the number of days would depend on the amount of revenue collected through the tax on Internet purchases. The more money collected, the longer the holiday.

Lawmakers for years have looked at online sales as a possible source of tax revenue – noting that the taxes are supposed to be paid, but aren’t because there’s no enforcement mechanism, particularly with out-of-state sellers.

The economists estimated that if the sales tax holiday were extended to 10 days, the savings would grow to around $51 million.

Nelson Eyes Governor’s Race If Crist ‘Gets Into Trouble’

November 21, 2013

After months of playing coy, U.S. Sen. Bill Nelson for the first time on Tuesday publicly acknowledged he is keeping open the option of running for governor.

Nelson, Florida’s only statewide elected Democrat, has repeatedly insisted he doesn’t intend to enter the race. But on Tuesday, Politico reported Nelson said that could change if newly-minted Democrat Charlie Crist, the one-time Republican governor of Florida who announced his candidacy two weeks ago, “gets into trouble.”

When asked to elaborate, Nelson said, “That’s in the eye of the beholder,” according to Politico.

Nelson spokesman Dan McLaughlin said in an e-mail he “had nothing to add” to the Politico report, which initially said that Nelson reiterated his mantra of having no intention of running.

Nelson spokesman Dan McLaughlin said in an e-mail he “had nothing to add” to the Politico report, which initially said that Nelson reiterated his mantra of having no intention of running.

“He’s a nice man,” Crist, in Tallahassee schmoozing with reporters at the Florida Press Center, told The News Service of Florida when asked about Nelson’s initial comments about having no intention of running. “He’s my friend.”

Those close to both men on Tuesday shrugged off Nelson’s remarks, saying the 71-year-old senator merely stated out loud what everybody already knew. Nelson’s chief of staff Pete Mitchell said as much to powerful Florida Democrats in telephone calls over the past few weeks.

“I don’t really think he said anything today that isn’t common knowledge among the donors and the punditocracy,” said Crist’s chief political consultant Steve Schale, who also played a key campaign role in President Obama’s victories in Florida.

Former U.S. Sen. Bob Graham, who also served as governor and is one of Florida’s most highly-respected Democrats, agreed.

“I think it’s basically the status quo. He’s said it in different words but I think the basic idea is that he is not a candidate but is reserving the right to reconsider depending on future events,” Graham said.

But by erasing any doubt that he is waiting in the wings, Nelson could make it more difficult for Crist to win over some Democrats skeptical about Crist’s comeback chances. Some donors are worried that the populist Crist will be unable to overcome what is expected to be a blistering campaign by incumbent Gov. Rick Scott bolstered by national Republicans anxious to keep Florida’s governor’s mansion in GOP control. Scott reportedly plans to spend up to $100 million on the campaign.

“The senator is the senator. People listen to a U.S. senator very seriously. If it’s coming from (Nelson), obviously it’s a little different than coming from a third party,” said state Rep. Mark Pafford, D-West Palm Beach, slated to take over as head of the House Democratic caucus after next year’s elections.

But Schale said Nelson’s “wait-and-see” approach has been no secret for about a year and has done nothing to dampen fund-raising activities thus far.

Crist raised nearly $1 million in the first 10 days of his campaign “with all of the phone calls from Pete Mitchell happening and none of the walk-back,” Schale said.

“It doesn’t change anything. Charlie Crist is still running for governor. He’s still building a campaign. He’s still out there every day doing the kinds of things you do when you want to get elected governor. There’s nothing about this that’s changing any of that except that Bill Nelson’s not doing that,” he said.

Graham said that he doesn’t expect the possibility of a Democratic primary against Nelson to alter the course of Crist or potential contributors.

“His campaign with the help of people like Steve Schale has been in development for some time and I’m sure they’ve got a plan of action for all the elements of the campaign and they’re executing,” he said. “Most people who want to get into the campaign understand the importance for the candidate and for their own role of participation of getting in early.”

by Dara Kim, The News Service of Florida

Report: Number Of Uninsured Children In Florida On The Way Down

November 21, 2013

In the ongoing saga about health insurance, there is a glimmer of hope in Florida. The number of uninsured children in the state is heading in the right direction – down 14 percent since 2010.

That’s according to a report released Tuesday by the Georgetown University Center for Children and Families. Medicaid coverage for children and the Children’s Health Insurance Program (CHIP) both have made a big difference, said Leah Barber-Heinz, chief executive of Florida CHAIN, a group working to improve access to health care.

“That’s good news, and we’re continuing to see those numbers go down,” she said. “We still have an estimated 436,000 children going without health insurance, so there’s definitely room for improvement.”

“That’s good news, and we’re continuing to see those numbers go down,” she said. “We still have an estimated 436,000 children going without health insurance, so there’s definitely room for improvement.”

Florida still has a higher rate of uninsured children than the national average. A national poll released with the report indicates almost nine out of 10 people believe all children in their state should have health coverage.

In Florida, said Joan Alker, executive director of the Georgetown Center, the Latino community has the highest percentage of uninsured children, at about 38 percent. She said language barriers for parents and the need for outreach help explain the disproportionate number lacking coverage.

“We may be seeing children who are in mixed-status families, where the children are citizens but their parents may be immigrants,” she said. “We may have families, if there are immigrant parents, who are very reluctant to engage with the government and, indeed, fearful to engage with the government.”

Another barrier in Florida is that lawfully residing immigrant children have to wait five years before they are eligible for coverage. Barber-Heinz said she and others are hoping to change that in the next legislative session.

“When children are not healthy and they’re not able to go to school ready to learn,” she said, “everybody ends up absorbing costs of an unhealthy society.”

Florida also is one of six states that has yet to decide whether to opt into the Medicaid expansion provided under the Affordable Care Act. According to the Georgetown report, providing coverage to lower-income parents makes it more likely that their children’s health needs are being met as well.

By Stephanie Carroll Carson, Florida News Connection

Pictured: Rep. Jose Felix Diaz is among the sponsors of a KidCare Immigrant Bill in the upcoming Florida legislative session. It would eliminate the five-year waiting period for some immigrant children to obtain health insurance. Submitted photo for NorthEscambia.com, click to enalrge.

Escambia (FL) EMS To Continue Service To Flomaton

November 21, 2013

Escambia County is renewing an agreement with an Alabama agency to provide ambulance service for the Flomaton area.

Since 1981, Escambia County (FL) EMS has provided ambulance service to the Flomaton area through an interlocal agreement with the Escambia County (AL) Healthcare Authority. The initial current three year agreement approved in 2010 expires at midnight on December 7, 2013. The agreement will be renewed for two additional one year periods.

Since 1981, Escambia County (FL) EMS has provided ambulance service to the Flomaton area through an interlocal agreement with the Escambia County (AL) Healthcare Authority. The initial current three year agreement approved in 2010 expires at midnight on December 7, 2013. The agreement will be renewed for two additional one year periods.

Escambia County (AL) Healthcare Authority pays Escambia County EMS $7,873.39 a month for the ambulance service. Escambia County (FL) EMS then bill patients for services rendered.

A similar agreement is in place between Escambia County (FL) and the privately owned Atmore Ambulance service. Atmore Ambulance provides emergency medical services in the Walnut Hill and Bratt areas. Escambia County (FL) pays Atmore Ambulance $7,384.47 a month.

Atmore Ambulance also directly bills patients for services rendered at an amount not greater than that billed by Escambia County EMS, which provides ambulance service for the rest of the county.The agreement has been in place since 1978.

Pictured: Two brand new ambulances were delivered last week to Escambia County EMS Post 50 in Century. NorthEscambia.com photos, click to enlarge.