Tax Watch Group Takes A Look At Escambia Spending

June 21, 2008

The Florida TaxWatch Center for Local Government Studies released the results of its analysis of Escambia County government, Improving Transparency and Accountability in Escambia County government, at a press conference in Pensacola Friday morning.

The study, which was requested and funded by a group of Escambia County citizens who were concerned about escalating property taxes and the need for fiscal responsibility and integrity, finds that revenue and spending increases since 2000 are “unsustainable.”

“As Florida taxpayers, we are facing the perfect storm – the unfortunate convergence of social, economic, and political factors that will capsize our economy with catastrophic results unless we do everything in our power to change course,” warned Dominic M. Calabro, President and CEO of Florida TaxWatch, the nonpartisan, non-profit research institute and watchdog based in Tallahassee that conducted the study.

“This report focuses on the things that Escambia County government can change to avoid calamitous economic troubles in the future. Specifically, the report identifies five areas of government operation, over which the elected officials of Escambia County collectively have control, which should be improved.”

The report recommended that:

- The County should make a greater effort to control the growth of property taxes because recent revenue increases are unsustainable.

- The County should work to control costs because expenditures have grown significantly over the past five years, and in the current economic situation, Escambia County cannot expect to tax its way to prosperity.

- The County should maximize the use of resources by streamlining and being more careful about setting proper budget priorities. Specifically, the Board of County Commissioners and Constitutional Officers and/or their representatives need to establish a strategic and operational work plan for the County that can reduce duplication of effort and enhance the overall performance and effectiveness of County government.

- Better information is needed to support budget decision-making so the County should institute a system of performance measures to assist in setting and funding budget priorities that efficiently further the critical functions of government.

- The county should enhance communication with citizens by clearly stating the goals and accomplishments of the government in order to improve citizen understanding and trust.

This analysis was based upon (1) Escambia County’s historical spending practices and (2) a comparison of three comparable counties and the 67-county average for the State of Florida.

Among the specific factual findings of the report were that:

- Taxable property values doubled between fiscal years 2000 and 2007 with no decrease in millage rate. During this period the County’s property tax collections grew 92%, nearly five times greater than the combined growth in County population and inflation rates.

- Property tax revenues increased 27% in a single fiscal year (FY 2006 to FY 2007).

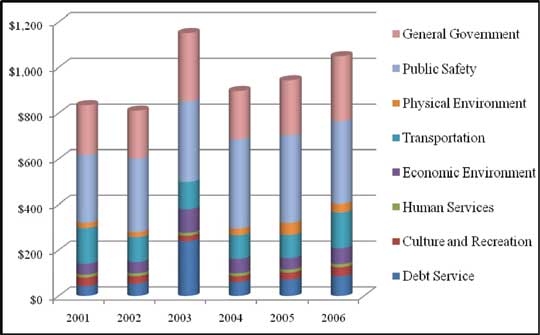

- The growth in expenditures per resident in Escambia County slightly exceeded the average for Florida’s 67 counties. Expenditures increased an average of 6.6% each year from FY 2001 – FY 2006, compared to 6.1% average annual increase for all counties.

- The total General Fund expenditures in FY 2007 (this past fiscal year) were nearly $25 million more than in FY2006, an increase of 18% in a single fiscal year.

- The County’s millage rate was higher than the “all county” average (i.e., the average (mean) of all of Florida’s 67 counties) and the three comparable counties.

- • Over 60 percent of the General Fund expenditures are made by the five Constitutional Officers (as opposed to the Board of County Commissioners).

To read the entire Florida TaxWatch report on Escambia County, click here (pdf format, 2 Mb)

Pictured above: A graphical look at how the tax revenue per person is spent in Escambia County.

Comments